Increase Your Networth

Our Focus

Our focus is triple net, single-credit tenant assets. While we’re still managing our current portfolio of commercial, multi-tenant properties, we may from time to time consider this asset class to add to our personal portfolio.

Understanding the Risks

At Rimadyl generic Investment Properties, we’re committed to guiding you through your investment journey with our extensive expertise. Our team specializes in procuring triple net properties to bolster our exclusive portfolio. These commercial real estate assets offer a dependable income source, extended lease terms, and minimal landlord obligations, making them an excellent choice for savvy investors. Don’t hesitate to contact us for valuable insights into real estate financing, acquisitions, and closing processes.

Financing

Operations

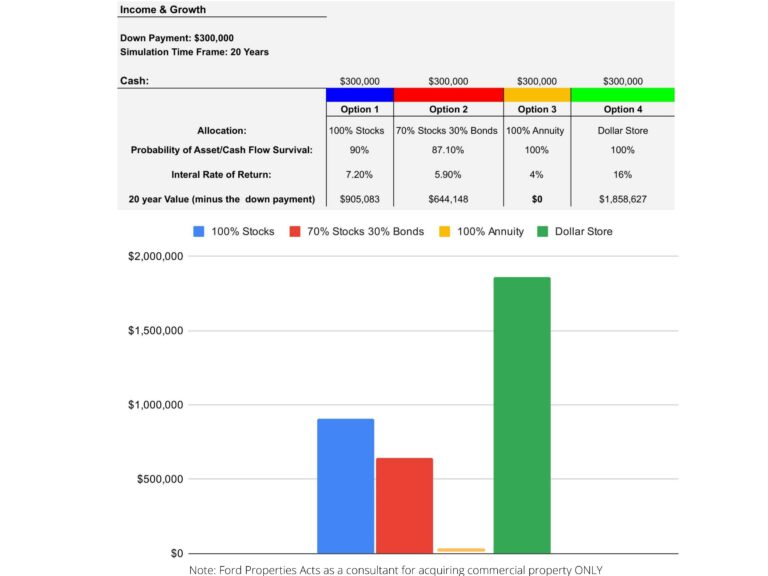

Financial Modeling

Ford Investment Properties is proudly powered by WordPress